In the world of investment, one approach that is most widely used to assess a company’s valuation is fundamental analysis. This method focuses on the evaluation of quantitative and quantitative factors that affect the financial health and operational performance of the company. By analyzing financial reports, industry conditions, and management strategies, fundamental analysis can help investors predict the growth potential and profitability of a company, and identify associated risks.

Fundamental analysis is an evaluation process used to determine the intrinsic value of a company or asset. The purpose of this analysis is to predict whether a stock or company is undervaiued or overvaIued based on existing data. Factors that are the main focus of fundamental analysis include

Balance sheet financial reports, Iaba loss reports, and cash flow reports provide a deeper picture of the company’s financial health.

Understanding how economic and industrial conditions can affect a company’s performance is critical in fundamental analysis.

Business models and management strategies increase the strength and weakness of a company’s business and management strategies.

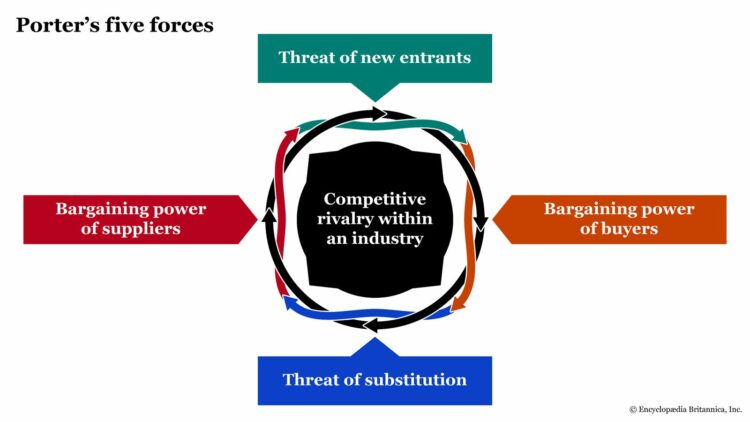

Competitive advantage and risk identify factors that can give a company an advantage in the market or actually increase the risks it faces.

Quantitative analysis focuses on non-financial factors that can affect a company’s performance. Several factors that are often analyzed include management skills and strong and experienced leadership skills can play a big role in a company’s long-term success. Competitive advantage and Product Differentiation determine whether a company has an advantage that allows it to compete in the market. Industry stability and prospects look at how the sector or industry in which the company operates is developing and the potential that exists. Legal and regulatory risks consideration of risks arising from changes in government regulations or regulations.

On the other hand, quantitative analysis presupposes numerical and statistical data to assess the financial performance of a company. Some important financial ratios are used among other profitability ratios such as Retum on Equity (ROE), Retum on Assets (ROA), and IABA margin, to determine how efficient a company is in providing Iaba.. Solvency ratio the ratio of debt to equity and current liquidity to assess the company’s ability to meet financial obligations. Efficiency ratios include inventory turnover and receivables turnover, which provide insight into how efficiently a company manages its assets.

After the analysis of quantitative and quantitative factors is done, the next step is to determine the intrinsic value of the stock. Intrinsic value is the fair price of a stock that is calculated based on the fundamental analysis that has been carried out. There are several methods used to calculate intrinsic cash flow, such as the discounted cash flow (DCF) method of calculating the present cash flow from a company’s expected future cash flow. The dividend growth model analyzes how a company’s dividends will grow and uses this to determine the stock’s valuation. The asset and liability model determines the company’s valuation based on the total assets and liabilities owned.

After determining the intrinsic value of the stock, investors can compare it with the current stock market price. If the market price is lower than the intrinsic value, then the stock is considered undervaIued, and can be an attractive investment. If the market price is higher than the intrinsic value, the stock is considered overvaIued and may be a risky investment. The Margin of safety is the difference between the intrinsic value and the stock market price. This Margin provides investors with a layer of protection to reduce investment risk. The greater the margin of safety, the lower the risk of investment that diambiI, because investors buy shares with a price that is much lower than the company’s reasonable price.

Stock investment is never free from risk. Some types of risk need to be considered among other market risks market volatility can affect stock prices in the short term. Business risk factors within a company, such as poor management or operational problems, can affect stock performance. Some stocks may be difficult to sell in the market at the desired price.

To mitigate this risk, investors can diversify their portfolios, choose stocks from a variety of sectors or industries, and adopt long-term investment strategies that reduce the impact of market fluctuations.

Fundamental analysis is a powerful tool for assessing a company’s growth potential and financial health. By using this approach, investors can determine whether a stock is priced higher or lower than a reasonable valuation, and understand the risks associated with the investment. It is important to note that although fundamental analysis provides deep insight, its outcome remains dependent on many extemporaneous factors that can change, such as market and economic conditions. In the investment world, learning fundamental analysis is the key to making better decisions and building a healthy and profitable long-term portfolio.